Customer Services

Copyright © 2025 Desertcart Holdings Limited

Desert Online General Trading LLC

Dubai, United Arab Emirates

Full description not available

R**S

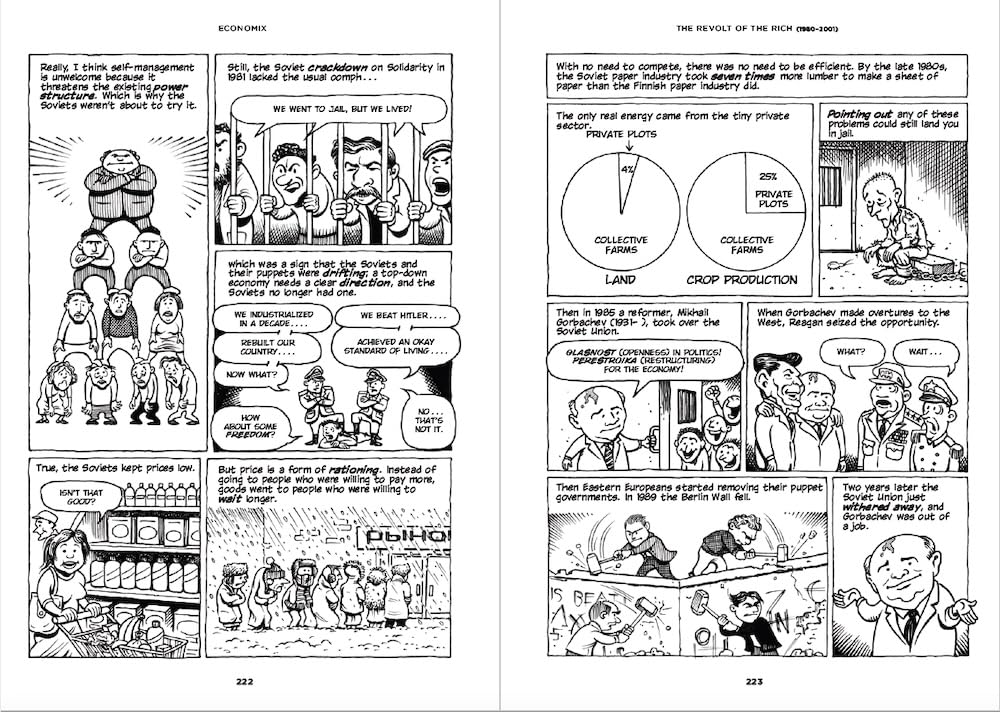

Good introduction to economics

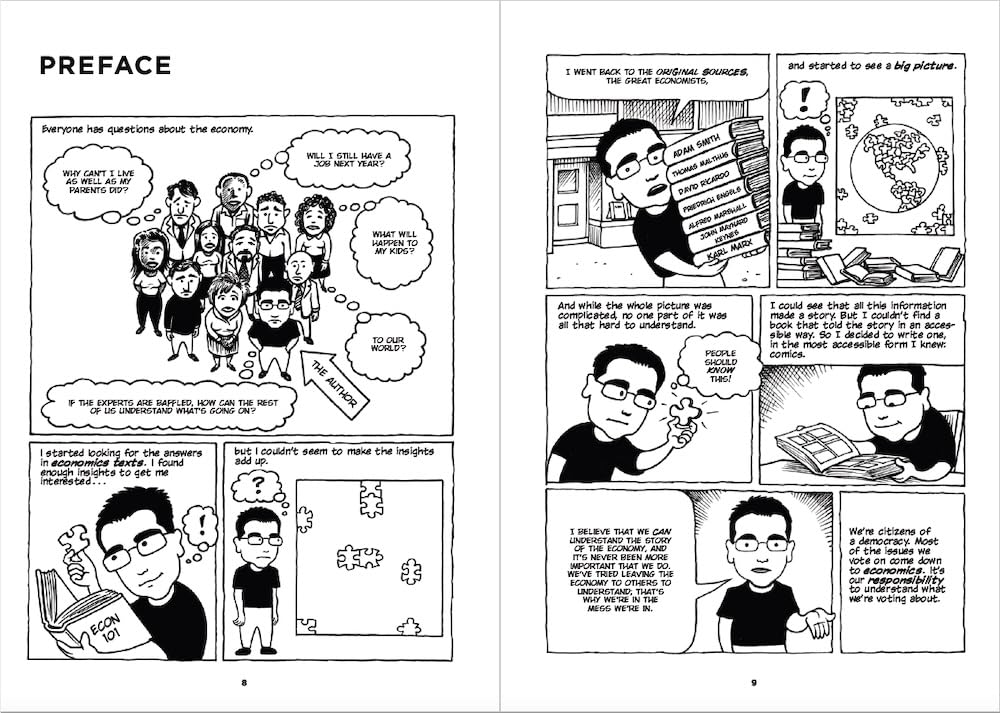

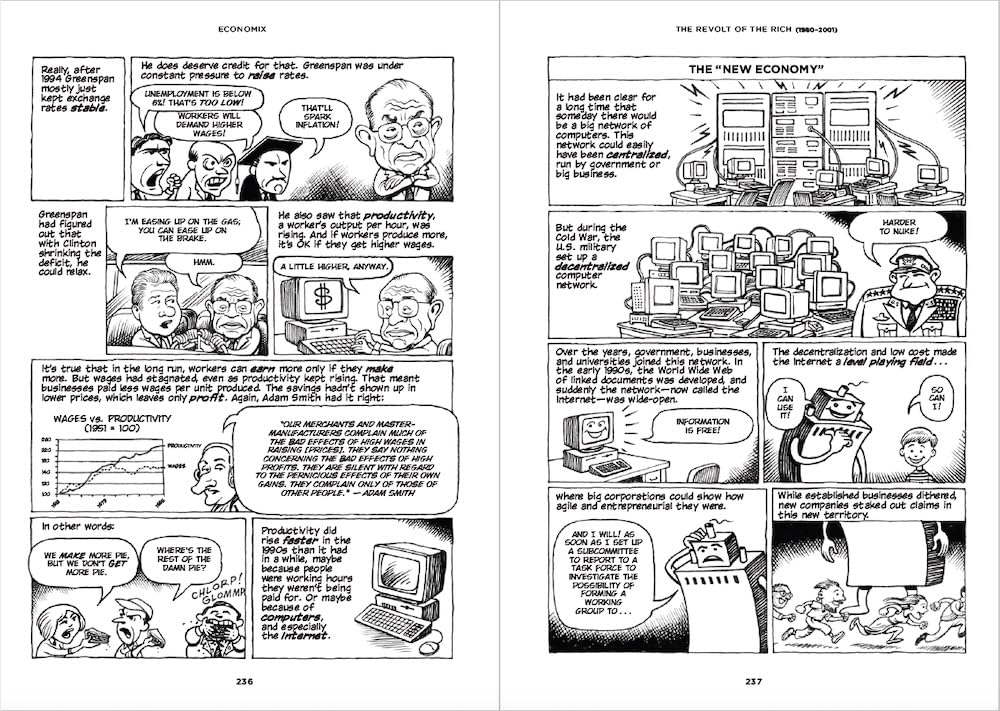

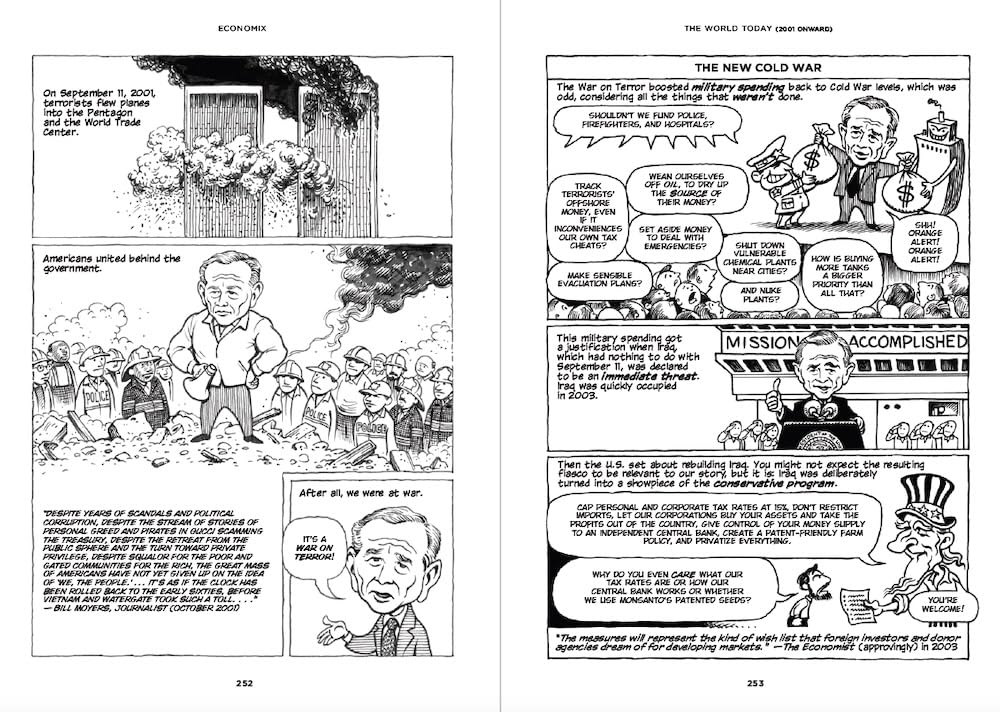

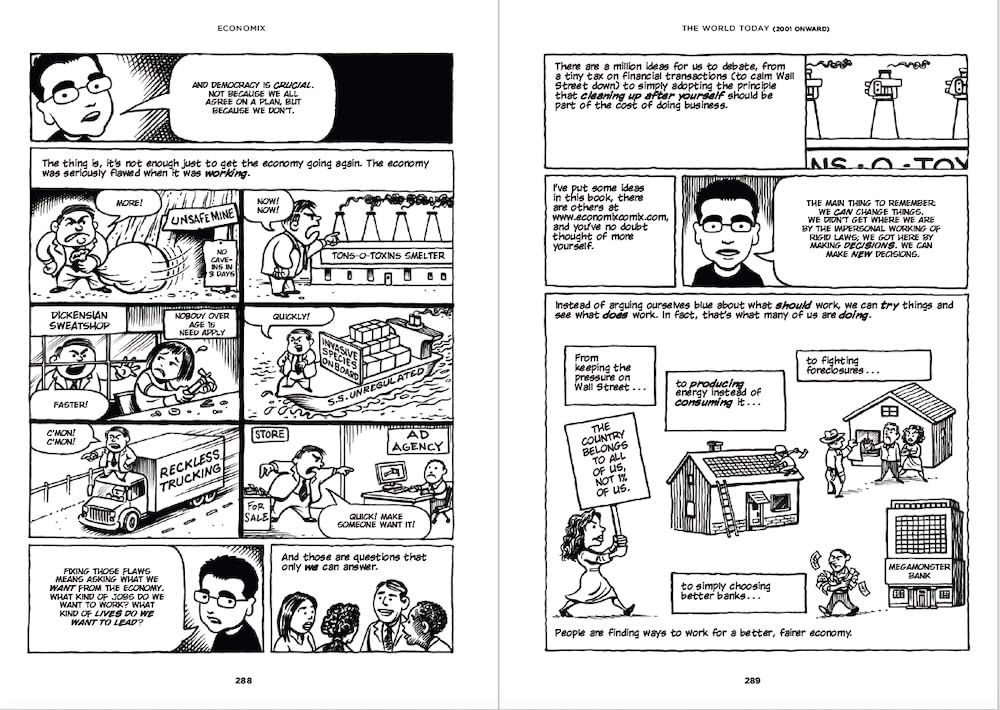

Students beginning to study economics should be required to read this book first, so they know that the mind-numbingly boring, academic stuff that they're going to study in a college economics course--the abstruse theories, mathematical formulas, and All-Other-Things-Being-Equal models divorced from actual human behavior--does have a relationship, albeit rather tenuous, to the real-world economy that that we experience in our daily lives as workers, consumers, and voters.Some bad reviews argue that Goodwin has a bias, but people of any political stripe will benefit from considering the historical information the author presents. For instance, how many people know that many of the social welfare programs that we take for granted today were created to deal with the great depression? How many people know how recently the 8 hour workday came about? And imagine if voters really understood the concept of "externalities"; would Republicans have dared to try to make an issue of the president's statement that the rich did not build their businesses all by themselves, but received help from the taxpayers?The book's discussion of Adam Smith will come as a revelation to people who learned everything they know about "The Wealth of Nations" from free-market apologists. Smith endorsed government regulation to curb the abuses of big capitalists "whose interest is never exactly the same as that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it." So, Adam Smith--not as big a fan of the "invisible hand" as Fox News pundits would have you believe.An underlying theme of the book is that there is a connection between economic theories and political power and this is probably what is most infuriating to reviewers who want you to believe that their hostility to taxes and regulations is based on "scientific" theories of economic behavior. If you recognize that a lot of economic argument is not based on objective "laws", but is actually nothing more than self-serving rationalization for particular policy choices (not to mention spreadsheet errors), you will examine political arguments more critically and begin to take responsibility for your political choices.

S**E

The comic style only makes it better.

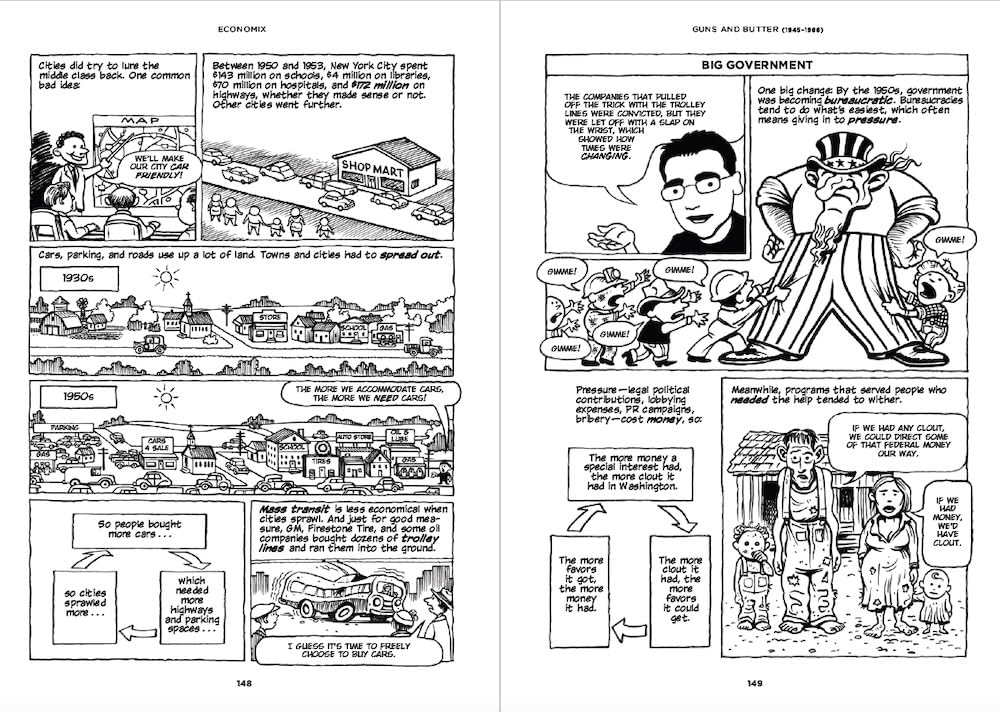

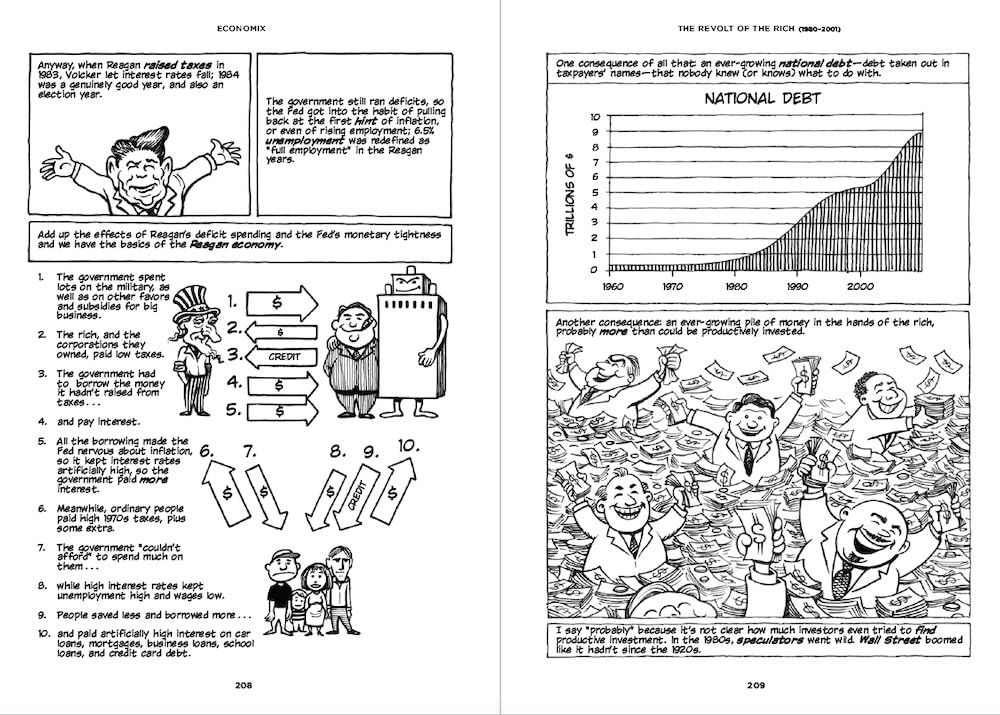

I’m not sure how and what sparked my interest in economics, perhaps it was Kathryn Tanner’s Economy of Grace or the fact that I’m disillusioned by both capitalism and communism or the fact that I am in near constant financial crisis (aka, the normal graduate student life and post-American-college-with-their-stupid-student-debt). Nevertheless, I am glad I read this.Economix came up as one of the most recommended introductions to the history of economics — according to Reddit. I appreciate how Michael Goodwin opens the book: he confesses that modern economists are, at times, beyond confusing and inconsistent and that primary sources are the way to go. When he went back to the original sources, the sources all the modern economists were quoting, he found that (1) primary sources were more often than not taken out of context and (2) primary sources had some faulty assumptions and ideals [like the Supple and Demand chart assumes an ideal economy with stagnant desires, resources, political climate, etc. In this sense, the Supple and Demand chart is a very flat, 2-dimensional model]. For example, laissez-faire (“let it be”) might have worked in a pre-industrialized, pre-technologically-advanced, pre-globalized country–but the success was short lived. Most 20th century communism models picked and choose what they liked from Marx (to his great frustration, assumingly). Reagonomics, tickle-down economics, and tax cutting the rich and major corporations pretty much ruined everything. So, along with Reddit, I cannot recommend this enough. Plus, the comic book form is amazing. The book, though, is not without faults, but as an introduction it is very informative.Economics is much more than just money — it is political, psychological, sociological, philosophical, and, agreeing with Tanner, theological. So, as much as I did not want to learn a lick of economics, as someone who wants to be a theologian, I must learn more economics: it is both exciting and dreadful.sooholee.wordpress

Trustpilot

1 week ago

1 month ago