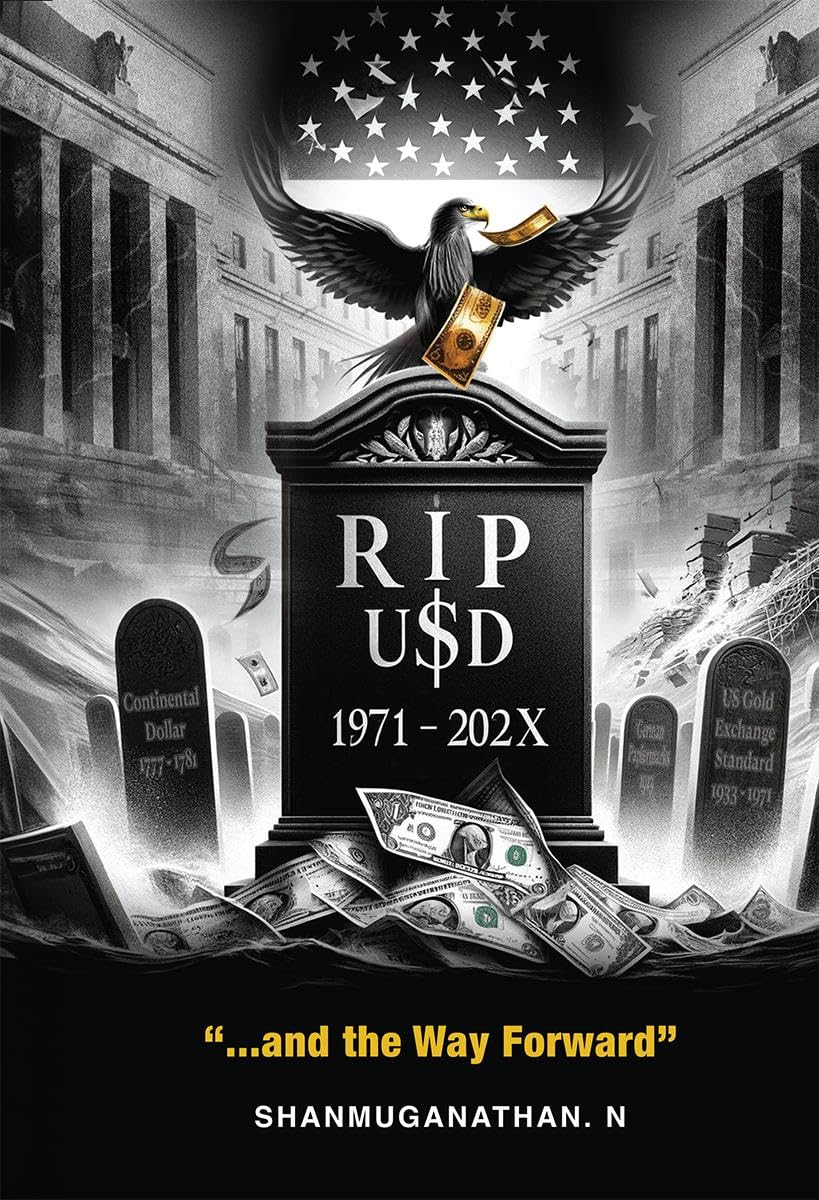

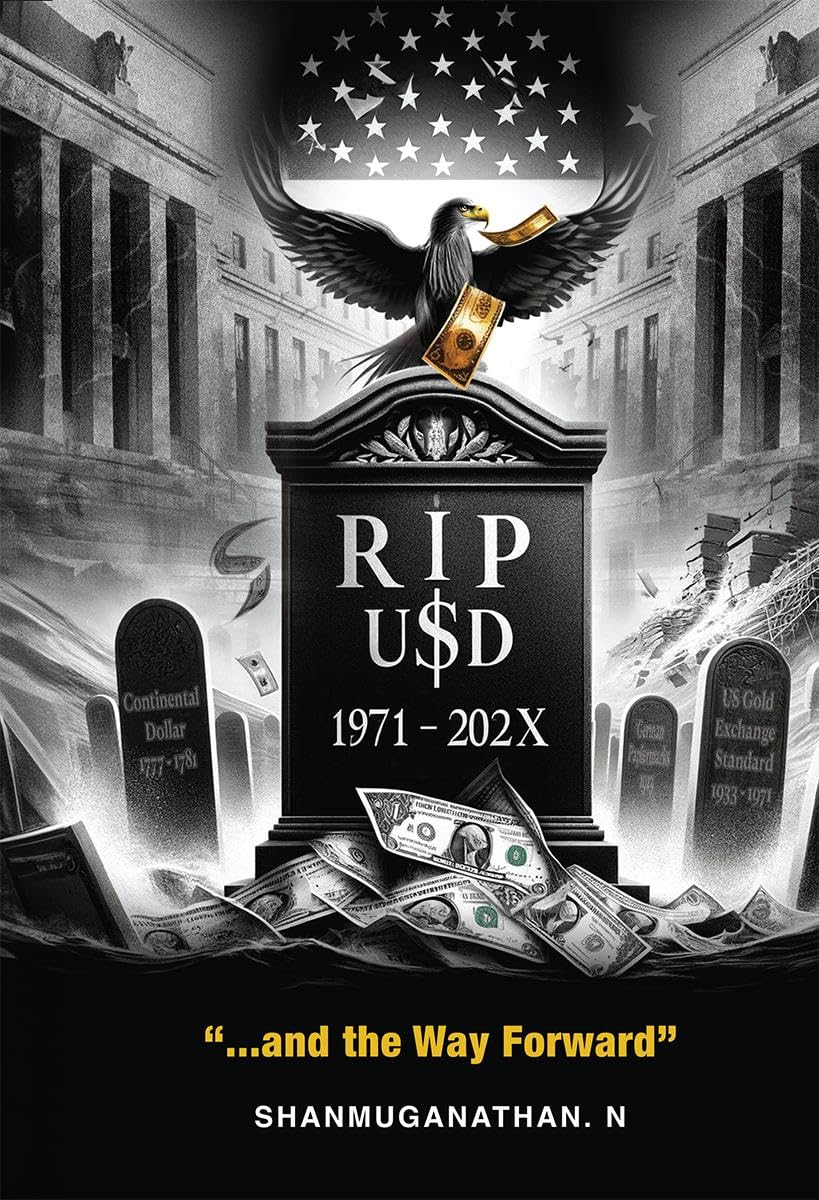

RIP USD: 1971 - 202X ...and the Way Forward

T**R

A very compelling read

Book Review 📚 - I finished reading "RIP USD: 1971 - 202X ...and the Way Forward" by Shanmuganathan N . This book offers a thought-provoking and timely exploration of the global monetary system, with a focus on the USD's dominance and its potential decline. The author delves into the historical, economic, and geopolitical factors that have established the USD as the world's reserve currency and presents a compelling argument for why this era might be nearing its end.The US currently has $34 trillion in national debt, which constitutes 123% of its GDP and is growing at an annual rate of $3 trillion. This escalating debt is alarming for several reasons:✴️ It exceeds GDP growth, meaning the economy isn't expanding at a comparable pace, and the new debt isn't creating equivalent value.✴️ The current Federal Reserve rate is 5.25%, while the average rate on the national debt is 3.3%. Much of this debt was issued at lower rates in previous years, and as these older debts mature and are reissued at higher rates, the government's interest burden will increase.✴️ To manage this debt, the Federal Reserve may increase the money supply, leading to higher inflation. This could mirror past financial bubbles, like those of the Nasdaq in 2000 and the 2008 Global Financial Crisis.These factors place the USD in a precarious position, potentially leading to its collapse within the next 3-5 years. However, it's not beyond saving. The US government could:✅️ Reduce global military expenditures and avoid unnecessary geopolitical interventions.✅️ Increase gold reserves to bolster the gold backing of the USD, as the current money supply is 12 times the Fed's gold reserves.The world has recognized the risks associated with the USD and has begun accumulating gold, the safest and most universally accepted asset. This accumulation of gold by the Federal Reserve and other countries, coupled with increasing retail demand of gold, could significantly drive up its value over the next 3-5 years.📚 This book is essential reading for anyone interested in economics, finance, and geopolitical trends, providing both a historical overview and a forward-looking analysis that will resonate with scholars, policymakers, and general readers alike...🙏

P**Y

View backed by historical data

The author's perspective on the historical and contemporary stance of monetary policies and their effects is one that I truly appreciate. I highly suggest this book to everyone who wants to understand the how and why of the current policies and where are we heading with this. The author has done a great job of supporting his points of view with statistics.

P**N

A Whistle Blower for the World Economy

A well written, good read of a book, with an in-depth analysis of the world's monetary systems. Thoroughly researched and simply explained, shows the efforts taken to bring about this eye-opener of a book, for the financial world. Might benefit anyone, who is inclined to spend some time reading this.

P**R

Great work

Must read book.Appreciate the indepth knowledge of Author who keeps you engaged throughout 244 pages.I can easily visualise the amount of effort put in by him to bring out this excellent book.

S**N

It is revelation.

An interesting book by Shanmuganathan. The Author has , with many lucid illustrations , thrown light on how easy it is for the US Govt to print Dollars with no Gold backing and how all other countries which use it as their trading currency , pay a price for it ! A Must Read for those who want to insulate themselves from the impending risks .

S**Y

American economy in distress

The most informative and detailed analysis of American economyMust read for all sections of societySuperb effort for understanding the current American economic scenario

Trustpilot

2 months ago

2 months ago